The Magic of Multiplying in SIP (Mutual Fund)

The Magic of Multiplying in SIP (Mutual Fund)

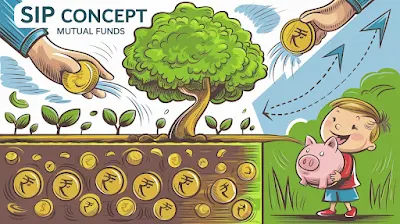

Do you know why a tiny seed grows into a giant tree after years? Similarly, an initial amount of money invested at regular intervals in a mutual fund through SIP (Systematic Investment Plan) can become a sizeable amount of money over a certain period. It is due to the effect of compounding, which is also referred to as multiplying.

What is SIP?

SIP stands for Systematic Investment Plan. It is a mutual fund investment. You don't invest a bulk amount at a time. You invest a fixed amount every month. It's like saving your pocket money every month and watching it grow to a huge amount.

How Does SIP Work?

Let's understand that with a simple example. You deposit ₹500 every month in a piggy bank. In a year, you will have ₹6,000. But if you deposit the same ₹500 every month in an SIP, it won't remain stagnant—it will increase! Why? Because money deposited earns more money at a later date, and that earned money earns more money. That's called the power of compounding.

The Power of Compounding

Compounding is a magic trick where your money grows by itself. Let's say you invest ₹500 in an SIP every month. This money earns some profit, and that profit is added to your total amount. The following month, you will earn profit on your money as well as the profit you have already earned. After some years, this small amount becomes a large amount.

Let's consider an example:

You contribute ₹500 a month.

After 1 year, you have ₹6,000.

After 5 years, this is ₹30,000.

After 10 years, due to compounding, this sum is far greater—perhaps even over ₹1,00,000!

Why SIP is the Best Mode of Investment?

Easy to Start – You don't require a big amount to invest. You can start investing with as little as ₹500 or even less.

Grows Your Money – Your little savings amount to a huge sum after a period of time.

Less Risky – Since you are investing a small amount every month, you will never lose your funds even if the market is up and down.

Good Habit – It teaches you how to invest and save every month, as you save your pocket money.

Patience is the Key

The majority of individuals stop investing in SIP after a few months because they don't see any significant change. But like a seed needs time to grow into a tree, the same happens with SIP as it also needs time to show its magic. The more you stay invested, the more your money grows.

Conclusion

SIP is a wise method of saving and increasing money. Even if you possess less, after years and years, it turns into a large sum due to the strength of multiplication. Just like how you increase in height each year, your money will also increase if you are patient. So, if you invest at an early point and are patient, you will have a bright future with your savings!

So why wait? Keep investing, keep saving, and watch your money grow like a tree!

Comments

Post a Comment